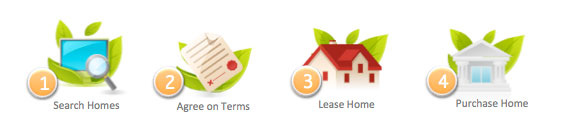

Rent To Own buyers and sellers enter into a lease agreement for a fixed period of up to 36 months. At the conclusion of the lease, the buyer will have the option to purchase the home from the seller.

In addition to the down payment credit, the Seller may offer monthly rent credits. A “rent credit” is a portion of the monthly lease payment that is applied to the overall purchase price if and when the Rent To Own purchase is executed at the end of the lease. The amount of the rent credit and the down payment will vary by each seller and property.

The purchase price will be determined before the Rent To Own lease agreement is finalized and signed by both buyer and seller. This price is fixed and will not change after negotiated and agreed upon by both parties.

Before entering into a rent to own transaction, tenant-buyers should consult with financial experts to develop an achievable roadmap to a successful loan approval and home purchase. Mortgage professionals can provide lending guidelines including minimum FICO score, maximum debt-to-income ratio and minimum required down-payment. With these objectives in mind, if necessary, credit improvement consultants and financial advisors can help you to raise your credit score and build up your savings.

Sample Rent To Own Transactions(Assumes 24 Month Lease) |

Sample Transaction #1 | Sample Transaction #2 | Sample Transaction #3 |

| Purchase Price | $200,000 | $400,000 | $600,000 |

| Rent To Own Down Payment (3%) | $6,000 | $12,000 | $18,000 |

| Total Monthly Payment | $1,600 | $3,200 | $4,800 |

| Monthly Rent Credit | $300 | $600 | $900 |

| Amount Saved for Mortgage Down Payment | $13,200 | $26,400 | $39,600 |